Description

Buy Prepaid Credit Cards

Buy Prepaid Credit Cards, Do you have questions regarding where to Buy Prepaid Credit Cards without the hassle? As a result, we will be the finest option for purchasing a prepaid visa card. We are overjoyed that you have found us, and you will be as well, because we are here to supply you with the best prepaid visa cards available in the most user-friendly manner.

We offer the Buy Prepaid Credit Cards, which comes with a full money-back guarantee. You don’t have to worry about the safety of acquiring prepaid cards from us. I can assure you that purchasing a prepaid card online is completely secure. So, if you’re wanting to get a prepaid Visa Card, this may be the best option.

This card can be used to make online transactions everywhere Visa cards are accepted. As a result, even if you don’t have a credit card, visa card, or Buy Prepaid Credit Cards, you can receive a Prepaid Credit Cards. Visa prepaid cards are accessible for purchase online, and any quantity of Buy Prepaid Credit Cards can be purchased with ease. Don’t be late as a result! It is now possible to Buy Prepaid Credit Cards online. It is free and accessible to the public.

Prepaid Credit Cards

Buy Prepaid credit cards are a popular financial tool that allows users to load a specific amount of money onto a card, which can then be used for purchases until the balance is depleted. Unlike traditional credit cards, prepaid cards do not require a credit check and do not allow users to spend beyond the amount loaded onto the card. This document explores the features, benefits, and potential drawbacks of prepaid credit cards, as well as their various applications in everyday life.

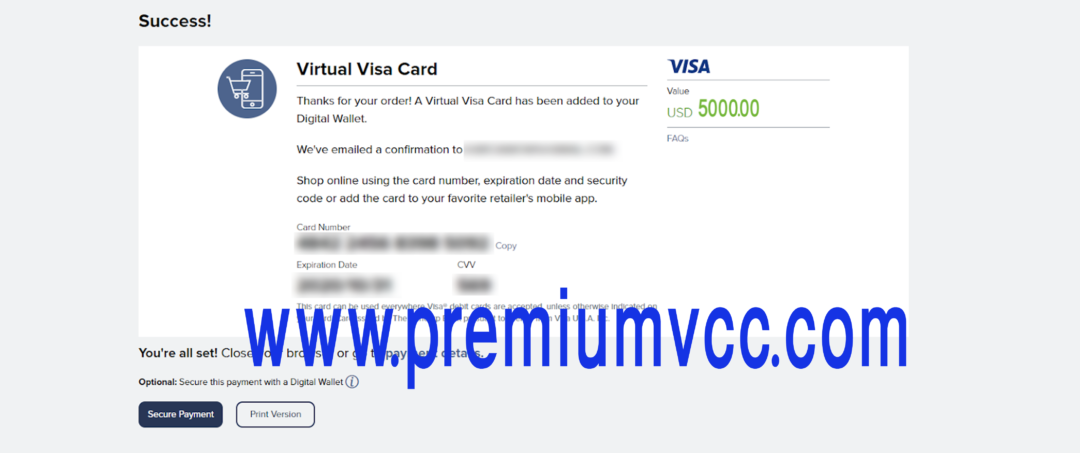

Proof Of Visa Prepaid Card Loaded Amount

What is Virtual Prepaid Card?

Buy virtual prepaid Card, Before you get a prepaid visa card, you should learn about it. As the name implies, Buy Prepaid Credit Cards that must be pre-loaded with funds before being used for payment. A prepaid card is also known as a Stored Value Card (SVC). A prepaid card is not associated with a bank account or any other financial institution. Money is loaded directly into the Card instead, and it can be reloaded at any moment.

Visa Card is a Visa network-enabled electronic payment card issued by Visa Inc.

Visa cards are not distributed directly by the corporation; instead, they are issued through affiliated financial companies that have been granted a license to use the Visa card. Visa also offers Buy Prepaid Credit Cards, Visa Debit Cards, Visa Gift Cards, and Visa Prepaid Cards. So, what exactly is a Prepaid Visa Card, exactly?

Buy Prepaid Credit Cards is a rectangular piece of plastic that can be used to make automated purchases. A Prepaid Visa Card, like any other prepaid Card, is pre-loaded with money, and only the Card will be able to use it to make purchases. You can reload a reloadable Prepaid Visa card with money at any time.

Search Google: Buy Prepaid Credit Cards,Buy Prepaid Credit Card,buy Prepaid Visa Card,Prepaid Visa Cards,Prepaid Visa Card,buy Prepaid Visa Card,buy preloaded card,buy preloaded cards,buy online Prepaid Credit Card,buy online Prepaid Credit Cards,buy online visa prepaid card,buy online visa prepaid cards,Buy Virtual Prepaid Card Online Payment Card,Buy Virtual Prepaid Card Online Payment Cards,Buy Virtual Prepaid Card Online,Buy Virtual Prepaid Card Online card,Buy Virtual Prepaid Card Online cards,Buy Prepaid Credit Cards for online shopping,Buy Prepaid Credit Cards for online shopping card,Buy Prepaid Credit Cards for online shopping cards,buy reloaded card,buy reloaded cards,Buy Prepaid Credit Cards 2025,Buy Prepaid Credit Card 2025.

Buy Prepaid Credit Cards

Buy Prepaid Credit Cards,In today’s fast-paced digital world, the need for secure and convenient online payment methods has never been greater. Buy Prepaid Credit Cards offer a solution that addresses these concerns, providing a safe and efficient way to make Buy Prepaid Credit Cards online. With an increasing number of people turning to online shopping for everything from groceries to clothing, virtual prepaid cards offer a practical and versatile option for managing your finances in the digital age. There are several compelling reasons to consider purchasing a virtual prepaid card. One of the key advantages is increased security, as these cards are not linked to your bank account and can be easily replaced if lost or stolen. Additionally, virtual prepaid cards can help you stick to a budget by allowing you to load only a specific amount of funds onto the card, preventing overspending. Whether you’re wary of sharing your personal financial information online or simply looking for a convenient way to manage your online purchases, Buy Prepaid Credit Cards offer a flexible and secure payment option that is well-suited to the demands of modern life.

Benefits of Prepaid Credit Cards Convenient online shopping Secure way to make payments Easy budget management No risk of overspending Flexibility and Accessibility Accepted worldwide No need for physical card Instantly available for use Protection from Identity Theft No personal information

Benefits of Buy Prepaid Credit Cards

Buy Prepaid Credit Cards,In today’s digital age, virtual prepaid cards have become a popular and convenient way to make online purchases and manage your finances. There are several benefits to using Prepaid Credit Cards that make them a smart choice for consumers looking for a secure, flexible, and hassle-free payment option. One of the key benefits of Buy Prepaid Credit Cards is the high level of security they offer. Unlike traditional credit or debit cards, Buy Prepaid Credit Cards are not linked to your bank account or personal information. This means that even if your card details are compromised, hackers will not be able to access your bank account or rack up fraudulent charges.

This added layer of security can give you peace of mind when making online purchases or sharing your card details with online merchants. Another advantage of virtual prepaid cards is their flexibility and convenience. Buy Virtual Prepaid Card – Online Payment Card can be easily purchased online and loaded with a specific amount of money, allowing you to control your spending and stick to a budget. They can also be easily reloaded with more funds as needed, making them a convenient option for regular online shoppers or travelers who want to avoid carrying large sums of cash.

Buy Prepaid Credit Cards are also a great option for those who have difficulty obtaining a traditional credit card or who want to avoid the temptation of overspending. Since virtual prepaid cards are preloaded with a specific amount of money, you can only spend what you have available on the card. This can help you avoid accumulating debt or getting into financial trouble, making them a great option for young adults, students, or those on a tight budget. Another benefit of Buy Prepaid Credit Cards is their global acceptance.

Buy Prepaid Credit Cards can be used to make purchases online from any merchant that accepts major credit or debit cards, making them a convenient option for international travel or online shopping. Additionally, virtual prepaid cards can often be used to make in-store purchases with a mobile wallet app, giving you even more flexibility and convenience when it comes to making payments. Finally, virtual prepaid cards offer added protection against identity theft and fraud.

Since virtual prepaid cards are not linked to your personal information or bank account, they offer an extra layer of security when making online purchases. If your card details are compromised, you can simply cancel the card and get a new one without risking any additional financial harm. In conclusion, virtual prepaid cards offer a wide range of benefits that make them a smart choice for consumers looking for a secure, convenient, and flexible payment option. From the high level of security they offer to their global acceptance and ease of use, Prepaid Credit Cards can help you manage your finances more effectively and make online shopping a breeze. Whether you’re looking to stick to a budget, avoid overspending, or simply protect your personal information, buy virtual prepaid cards are a smart choice for today’s digital consumer.

Convenient online shopping

Buy Virtual Prepaid Card,In today’s digital age, online shopping has become increasingly popular among consumers looking for convenience and variety. With a virtual prepaid card, shopping online just got even easier. Here are some top reasons why a virtual prepaid card can greatly enhance your online shopping experience. First and foremost, Buy Prepaid Credit Cards offers a convenient and secure payment method for online purchases. Instead of having to enter your personal credit card information every time you make a purchase, you can simply use your virtual prepaid card details. This helps protect your sensitive financial information from potential security breaches or fraud.

Another key benefit of Buy Prepaid Credit Cards for online shopping is the ability to set spending limits. By loading a specific amount of funds onto your virtual card, you can control how much you spend online. This is especially useful for budget-conscious shoppers who want to avoid overspending or impulse purchases. Furthermore, Buy Virtual Prepaid Card – Online Payment Card are widely accepted by most online retailers, making them a versatile payment option for a wide range of products and services. Whether you’re buying clothes, electronics, or even booking travel accommodations, you can simply input your virtual card details and complete your transaction in just a few clicks. Virtual prepaid cards also offer added convenience when it comes to managing your online purchases,Buy Virtual Prepaid Card.

You can easily track your spending, view transaction history, and reload funds as needed, all from the comfort of your own home. This level of accessibility and control can help you stay on top of your finances and make smarter purchasing decisions. Additionally, Buy Prepaid Credit Cards are a great option for those who may not have access to traditional credit cards or bank accounts. Whether you’re a student, freelancer, or simply prefer not to use a credit card, Buy Prepaid Credit Cards can be a viable alternative for making online purchases without the need for a physical banking account.

Lastly, Buy Prepaid Credit Cards offer a level of anonymity and privacy that can be appealing to some shoppers. Because virtual prepaid cards are not linked to your personal bank account, you can maintain a certain level of discretion when making online purchases. This can be especially beneficial if you value your privacy and prefer to keep your financial transactions separate from your personal banking information. In conclusion, a Prepaid Credit Cards is a convenient and versatile payment option for online shopping. From enhanced security and spending control to widespread acceptance and ease of use, there are numerous advantages to using a Prepaid Credit Cards for your online purchases. Consider getting a Prepaid Credit Cards today and experience the benefits for yourself,Buy Prepaid Credit Cards.

Secure way to make payments

Buy Prepaid Credit Cards,In today’s digital age, making payments online has become a common practice for many individuals. Whether you are shopping online, paying bills, or even transferring money to friends and family, having a secure way to make payments is essential. This is where virtual prepaid cards come in. One of the top reasons to buy a virtual prepaid card is the added layer of security it provides when making online payments. Unlike traditional credit or debit cards, Prepaid Credit Cards are not tied to your bank account. Instead, they are preloaded with a specific amount of money, reducing the risk of fraud or identity theft.

When you use a virtual prepaid card to make a purchase online, you are not sharing your personal banking information with the merchant. This minimizes the chance of your financial information falling into the wrong hands. Additionally, some virtual prepaid cards offer additional security features such as one-time use card numbers or the ability to lock the card when it is not in use. Another benefit of using a virtual prepaid card for online payments is the ability to control your spending. By preloading a specific amount of money onto the card, you can set a budget for yourself and avoid overspending.

This is especially useful for individuals who struggle with impulse buying or want to track their online purchases more effectively. Virtual prepaid cards are also a great option for individuals who do not have access to a traditional credit card or bank account. Whether you are a student, a young adult just starting out, or someone who prefers to use cash for most transactions, virtual prepaid cards offer a convenient and secure way to make online payments without the need for a traditional banking relationship. In addition to being secure, virtual prepaid cards are also convenient to use. Most virtual prepaid cards can be easily loaded with funds using a bank transfer, credit card, or cash at a retail location.

Once the card is loaded, you can use it to make purchases online just like you would with a traditional credit or debit card. Virtual prepaid cards are also accepted at most online merchants, making them a versatile payment option for a variety of different transactions. Whether you are shopping for groceries, booking travel accommodations, or paying for a subscription service, virtual prepaid cards offer a secure and convenient way to make payments without the need for a traditional credit or debit card. In conclusion, virtual prepaid cards are a secure, convenient, and versatile payment option for making online purchases. By providing an added layer of security, controlling your spending, and offering a convenient way to load funds, virtual prepaid cards are a great solution for individuals looking for a safer and more manageable way to make online payments,Buy Prepaid Credit Cards.

Easy budget management

Buy Virtual Prepaid Card, Managing your budget can be a stressful task, especially when it comes to keeping track of your spending and staying within your financial limits. This is where a virtual prepaid card can come in handy. One of the top reasons to buy a virtual prepaid card is the ease it provides for managing your budget. With a virtual prepaid card, you can load a specific amount of money onto the card and use it just like a traditional credit or debit card.

This can be a great way to limit your spending and avoid going over budget. Since you can only spend the amount of money that is loaded onto the card, it helps you stay disciplined and avoid unnecessary purchases. Additionally, virtual prepaid cards often come with features that make budget management even easier. For example, many virtual prepaid cards allow you to set spending limits for different categories, such as groceries, entertainment, or transportation. This can help you allocate your funds more effectively and track your spending in real-time.

Another benefit of using a virtual prepaid card for budget management is the ability to easily track your transactions. Most virtual prepaid cards come with online account management tools that allow you to view your transaction history, track your spending patterns, and set up alerts for low balances or unusual activity. This can help you stay on top of your finances and quickly identify any areas where you may be overspending.

Buy Prepaid Credit Cards are also a great option for budget management because they are not linked to your bank account. This means that if your card is lost or stolen, you won’t have to worry about unauthorized charges draining your bank account. You can simply report the card as lost or stolen and have it replaced without any risk to your personal finances. Overall, using a virtual prepaid card for budget management can provide you with the peace of mind knowing that you are staying within your financial limits and avoiding unnecessary debt. By setting spending limits, tracking your transactions, and utilizing the online tools provided by virtual prepaid card providers, you can effectively manage your budget and achieve your financial goals.

No risk of overspending

One of the top reasons to buy a virtual prepaid card is the fact that it eliminates the risk of overspending. Overspending can happen easily when using a traditional credit or debit card, because it’s so convenient to just swipe or tap and pay without really keeping track of how much money you’re spending. This can lead to financial stress, debt, and even credit score damage. With a virtual prepaid card, you have a set amount of money loaded onto the card, which acts as a hard cap for your spending. Once you reach the limit, you can’t spend any more unless you reload the card with additional funds. This can be a great way to stick to a budget and prevent impulse purchases that can throw off your financial goals. Another benefit of using a virtual prepaid card to avoid overspending is that it can help you stay accountable and disciplined with your spending habits. Because you have a set limit on the card, you need to be more mindful of each purchase you make and prioritize what’s really important to you. This can help you become more conscious of your spending patterns and make more intentional choices with your money. Virtual prepaid cards are also a great option for those who are trying to avoid accumulating debt. Since you can only spend what’s loaded onto the card, you won’t be able to rack up charges that you can’t afford to pay off. This can provide peace of mind and prevent you from falling into the cycle of debt that can be difficult to get out of.

Using a virtual prepaid card can also be a great way to teach responsible financial habits to younger individuals, such as teenagers or college students. By giving them a set amount of money on a prepaid card, you can help them learn how to manage their finances and make smart choices with their spending. This can set them up for success in the future and prevent them from making costly mistakes with credit cards or loans. In addition, virtual prepaid cards can also be a great option for those who have had issues with overspending in the past and want to regain control of their finances. By using a prepaid card, you can set clear boundaries for your spending and avoid the temptation to overspend on unnecessary items. This can be a valuable tool for creating healthier financial habits and working towards your long-term financial goals. Overall, the no-risk of overspending feature of virtual prepaid cards can be a game-changer for those looking to take control of their finances, avoid debt, and make more intentional choices with their spending. If you struggle with overspending or want to teach responsible financial habits to yourself or others, a virtual prepaid card could be the perfect solution.

Buy Prepaid Credit Cards offer a convenient and secure way to make online purchases without the need for a physical card. With added benefits such as budget control, no credit check required, and instant activation, they are a great option for anyone looking for a hassle-free payment solution. So why wait? Consider purchasing a virtual prepaid card today and experience the ease and flexibility it can bring to your online shopping experience,Buy Prepaid Credit Cards.

Flexibility and Accessibility

Flexibility and accessibility are two key reasons why purchasing a virtual prepaid card can be a smart decision for many consumers. Virtual prepaid cards offer a convenient and flexible way to make online purchases without the need for a traditional credit or debit card. One of the main advantages of a virtual prepaid card is its flexibility. These cards can be used just like a credit or debit card for online purchases, but they are not tied to a specific bank account. This means that you can easily manage your spending by loading a specific amount of money onto the card and using it until the funds run out. This can be a great tool for those who want to stick to a budget or for parents who want to give their children a safe and limited spending option. Virtual prepaid cards also offer accessibility that traditional credit and debit cards may not. Since they are not linked to a specific bank account, virtual prepaid cards can be easily obtained by anyone with an internet connection. This means that individuals who may not have access to a traditional bank account, such as teenagers or those with poor credit, can still make online purchases with ease. Another advantage of virtual prepaid cards in terms of flexibility and accessibility is the ability to use them across multiple platforms. Whether you are shopping on your favorite online retailers, paying for a subscription service, or making in-app purchases on your smartphone, virtual prepaid cards can be used across a wide range of platforms.

This versatility makes them a great choice for consumers who want the convenience of a card without being tied down to a specific financial institution. Virtual prepaid cards also offer peace of mind when it comes to security and privacy. Since they are not tied to a specific bank account, consumers do not have to worry about their personal and financial information being compromised in the event of a data breach. Virtual prepaid cards also often come with built-in security features such as fraud protection and the ability to easily freeze or cancel the card if it is lost or stolen. In conclusion, the flexibility and accessibility provided by virtual prepaid cards make them a practical and convenient option for consumers looking for a safe and secure way to make online purchases. With the ability to easily manage spending, use across multiple platforms, and ensure privacy and security, virtual prepaid cards offer a modern and efficient solution for those who want a convenient and flexible payment option.

Accepted worldwide

One of the most appealing aspects of virtual prepaid cards is their worldwide acceptance. These cards can be used for online purchases from anywhere in the world, making them an incredibly convenient option for those who like to shop internationally. When you purchase a virtual prepaid card, you are essentially buying a digital version of a traditional credit or debit card. This means that you can use your virtual prepaid card wherever major credit cards are accepted. Whether you’re buying flights, booking accommodations, or shopping for the latest fashion trends, a virtual prepaid card gives you the flexibility to make purchases from virtually any merchant that accepts credit cards. One of the benefits of using a virtual prepaid card for international purchases is the added security it provides. Since virtual prepaid cards are not directly linked to your bank account, you can shop online without having to worry about your sensitive financial information being exposed to potential hackers. This added layer of security can give you peace of mind when making purchases from unfamiliar websites or merchants. In addition to their security benefits, virtual prepaid cards are also a convenient option for travelers.

If you’re planning a trip abroad, having a virtual prepaid card in your wallet can make it easier to make purchases in foreign currencies. Instead of carrying around large amounts of cash, you can simply load your virtual prepaid card with the amount you need for your trip and use it like a regular credit card when making purchases overseas. Another advantage of virtual prepaid cards is their ease of use when shopping online. Many online retailers require you to have a credit card in order to make a purchase, and virtual prepaid cards can be a convenient alternative if you prefer not to use your regular credit or debit card for online transactions. With a virtual prepaid card, you can enjoy the convenience of online shopping without having to worry about potential fraud or unauthorized charges on your primary credit card. Overall, the worldwide acceptance of virtual prepaid cards makes them an attractive option for anyone who wants to shop online securely and conveniently. Whether you’re making purchases from international merchants, planning a trip abroad, or simply prefer to use a different payment method for online transactions, virtual prepaid cards offer a flexible and secure way to make purchases from anywhere in the world. Consider getting a virtual prepaid card to simplify your online shopping experience and enjoy the peace of mind that comes with enhanced security and convenience.

No need for physical card

One of the biggest advantages of purchasing a virtual prepaid card is the fact that it eliminates the need for a physical card. With a virtual prepaid card, all your card details are stored securely online, making it convenient and easy to make purchases without carrying around a physical card. One major benefit of not needing a physical card is the added security that comes with it. Since your card information is stored digitally, there is less risk of it getting lost or stolen. This provides peace of mind knowing that your financial information is safe and secure. Another advantage of not needing a physical card is the convenience it offers. With a virtual prepaid card, you can easily access your card details online and make purchases from anywhere with an internet connection. This means you don’t have to worry about forgetting your card at home or losing it while you’re out and about. Additionally, not needing a physical card can save you time and hassle. Gone are the days of waiting for a physical card to arrive in the mail or having to go to a bank or store to pick one up. With a virtual prepaid card, you can get instant access to your card details and start making purchases right away. Furthermore, not needing a physical card can also save you money. Most virtual prepaid cards come with low or no fees for activation, maintenance, or transactions. This can add up to significant savings over time compared to traditional credit or debit cards that may come with various fees. Lastly, not needing a physical card can also be more environmentally friendly. By opting for a virtual prepaid card, you can help reduce the need for plastic production and waste associated with physical cards. This small step can contribute to a more sustainable future for our planet. In conclusion, the decision to buy a virtual prepaid card can offer many benefits, with one of the most prominent being the elimination of the need for a physical card. From added security and convenience to saving time, money, and the environment, choosing a virtual prepaid card can be a smart and practical choice for managing your finances in today’s digital world.

Instantly available for use

Buy Virtual Prepaid Card, One of the top reasons to buy a virtual prepaid card is that it is instantly available for use. When you purchase a virtual prepaid card, you don’t have to wait for it to be shipped to you in the mail. Instead, you can receive the card details instantly upon purchase. This means that you can start using your virtual prepaid card right away, whether you need it for online shopping, bill payments, or any other online transactions. The instant availability of a virtual prepaid card can be especially useful in situations where you need to make a purchase quickly. For example, if you’re shopping online and come across a great deal that you don’t want to miss out on, having a Buy Virtual Prepaid Card – Online Payment Card ready to use can help you complete your purchase without any delays. Similarly, if you need to pay a bill online and want to do so right away, a virtual prepaid card can be a convenient and efficient payment method. Another benefit of the instant availability of a virtual prepaid card is that it can be a great option for last-minute gift giving.

Instead of having to rush to the store to pick up a physical gift card, you can simply purchase a virtual prepaid card online and send the card details to the recipient via email or text message. This way, the recipient can use the virtual prepaid card right away, without having to wait for a physical card to arrive in the mail. Additionally, the instant availability of a virtual prepaid card can be helpful for those who prefer to manage their finances digitally. With a virtual prepaid card, you can easily track your transactions and balance online or through a mobile app. This can make it easier to monitor your spending, set budgeting goals, and stay on top of your financials without having to worry about keeping track of a physical card or paper receipts. Overall, the instant availability of a virtual prepaid card offers convenience, speed, and flexibility for a variety of financial transactions. Whether you need to make a quick purchase, send a gift, or manage your finances digitally, a virtual prepaid card can be a practical and efficient solution. So, if you’re looking for a convenient and hassle-free way to make online payments, consider purchasing a virtual prepaid card for instant use.

Protection from Identity Theft

Identity theft is a serious concern in today’s digital world. With hackers constantly on the prowl for personal information, it’s more important than ever to safeguard your sensitive data. One way to protect yourself from the threat of identity theft is to use a virtual prepaid card. When you make purchases online or in-person with a traditional credit or debit card, you are exposing your account information to potential theft. If a hacker gains access to your card number, they can make unauthorized purchases, steal your funds, and even wreak havoc on your credit score. However, virtual prepaid cards offer a higher level of security by providing a layer of anonymity between your card and your personal information. Virtual prepaid cards are not linked to your bank account or any personal identifying information. Instead, they are issued with a unique card number, expiration date, and security code that are used for transactions. Since the card is not tied to your personal details, even if it is compromised, the thief will not have access to your bank account or other sensitive information.

Another benefit of using a virtual prepaid card for protection against identity theft is the ability to control how much money is loaded onto the card. By only loading the amount needed for a specific purchase, you can limit your potential losses if the card is stolen or compromised. Additionally, since virtual prepaid cards are not connected to your bank account, your overall financial security is not at risk if the card is breached. Virtual prepaid cards also offer the convenience of easy cancellation and replacement. If your card is lost or stolen, you can quickly deactivate it and request a new card with a new card number. This rapid response can prevent unauthorized charges from occurring and minimize the impact of identity theft on your finances. Furthermore, virtual prepaid cards are a great option for those who do not have access to traditional banking services. If you are hesitant to provide your personal banking information online or do not have a bank account, a virtual prepaid card can serve as a secure alternative for making purchases and managing your finances.

No personal information required

When it comes to online shopping or making purchases at various online platforms, protecting your personal information is of utmost importance. This is where virtual prepaid cards come into play. One of the top reasons people opt for virtual prepaid cards is the fact that no personal information is required to make a purchase. Unlike traditional credit or debit cards, virtual prepaid cards do not require you to provide sensitive personal information such as your name, address, or social security number. This provides an added layer of security and anonymity when it comes to online transactions, protecting your personal information from potential threats and fraud. Another reason why no personal information is required when using a virtual prepaid card is the convenience it offers. You can easily purchase a virtual prepaid card online without having to go through the time-consuming process of filling out paperwork or providing documentation. This makes it a quick and hassle-free option for those who value their time and privacy. Furthermore, not having to disclose personal information when using a virtual prepaid card can also help prevent identity theft and unauthorized purchases. Since virtual prepaid cards are not linked to your bank account or personal information, hackers and scammers are less likely to target you for fraud or phishing schemes.

In addition, using a virtual prepaid card without having to share personal information can also be beneficial for those who prefer to keep their financial history private. With a virtual prepaid card, you can make purchases without leaving a paper trail, making it ideal for those who value their financial privacy and confidentiality. Moreover, not having to provide personal information when using a virtual prepaid card can also be advantageous for frequent travelers or individuals who shop online internationally. Without the need to disclose personal information, you can make purchases across different countries without having to worry about currency conversion fees or foreign transaction charges that are typically associated with traditional credit or debit cards. Overall, the fact that no personal information is required when using a virtual prepaid card makes it a secure, convenient, and private option for making online purchases. Whether you are concerned about protecting your personal information, preventing identity theft, or maintaining financial privacy, virtual prepaid cards offer a practical solution that gives you peace of mind when it comes to online transactions. So, if you are looking for a safe and hassle-free way to make purchases online without compromising your personal information, consider getting a virtual prepaid card today.

Safe way to make online purchases

When making online purchases, safety should always be a top priority. With the rise of online shopping and the increasing number of data breaches, it is more important than ever to protect your sensitive information. This is where virtual prepaid cards come into play. Virtual prepaid cards provide a safe way to make online purchases because they do not require any personal information to be linked to your account. When you purchase a virtual prepaid card, you are given a unique card number, expiration date, and security code. These are the only details needed to make a purchase, keeping your personal and financial information secure. With traditional credit or debit cards, your sensitive information is stored on the merchant’s website after each transaction. This can leave you vulnerable to hackers who may try to steal your data. Virtual prepaid cards, on the other hand, do not store any of your personal information after the purchase is completed. This reduces the risk of your information being compromised. Another benefit of using virtual prepaid cards for online purchases is the ability to set spending limits. You can load a specific amount of money onto the card and only spend up to that limit. This is a great way to control your spending and prevent any unauthorized charges from occurring.

If someone were to get a hold of your virtual prepaid card information, they would only have access to the funds loaded onto the card, rather than your entire bank account. Virtual prepaid cards also offer protection against fraud. If your card information is compromised, you can easily cancel the card and request a new one. This is much easier and quicker than dealing with the process of disputing charges on a traditional credit or debit card. Furthermore, virtual prepaid cards are widely accepted by online merchants, making them a convenient option for making purchases. Whether you are shopping on a popular website or a smaller online retailer, you can use your virtual prepaid card with ease. This eliminates the need to enter your personal information repeatedly on different websites, reducing the risk of your data being exposed. In addition to safety and convenience, virtual prepaid cards are also a great way to budget your online spending. By using a virtual prepaid card, you can track your purchases and see exactly how much money you are spending online. This can help you stick to a budget and avoid overspending. Overall, virtual prepaid cards are a safe and secure way to make online purchases. With their unique card numbers, spending limits, and fraud protection, you can shop online with peace of mind. Whether you are concerned about protecting your personal information or managing your online spending, virtual prepaid cards offer a reliable solution for all your online shopping needs,Buy Prepaid Credit Cards.

Gift Giving Made Easy

Gift giving can be a lot of fun, but it can also be quite stressful. You want to find the perfect gift that the recipient will love, but sometimes it can be hard to know exactly what they want or need. That’s where virtual prepaid cards come in handy. One of the top reasons to buy a virtual prepaid card is that it makes gift giving easy. Instead of racking your brain trying to figure out what to get someone, you can simply purchase a virtual prepaid card and let the recipient choose their own gift. This takes the pressure off of you and ensures that the recipient will be able to get something they truly want. Virtual prepaid cards are also a great option for those hard-to-shop-for people in your life. Maybe you have a friend who seems to already have everything, or a family member who is notoriously picky. A virtual prepaid card allows them to browse and choose something they’ll actually use and enjoy. Another benefit of virtual prepaid cards is that they are convenient for both the buyer and the recipient. You can purchase a virtual prepaid card online with just a few clicks, and it will be delivered instantly via email. This means you can easily send a last-minute gift without having to worry about shipping times or delivery delays.

For the recipient, virtual prepaid cards can be used online or in-store, making them incredibly versatile. They can shop from the comfort of their own home or take their card with them on a shopping trip to their favorite store. This flexibility allows them to use their gift card in a way that best suits their needs and preferences. Virtual prepaid cards are also a great option for those who prefer to shop online. With the rise of e-commerce, more and more people are choosing to do their shopping online rather than in-person. A virtual prepaid card allows them to make purchases from their favorite online retailers without having to worry about entering their credit card information or dealing with complicated checkout processes. Additionally, virtual prepaid cards are a great option for those who want to give a gift that is both thoughtful and practical. Instead of giving a generic gift that may end up collecting dust on a shelf, a virtual prepaid card allows the recipient to choose something they will actually use and enjoy. This shows that you put thought and consideration into their gift, while still giving them the freedom to make their own choices. In conclusion, virtual prepaid cards are a convenient and versatile option for gift giving. They take the stress out of trying to find the perfect gift, allowing the recipient to choose something they truly want. With the ability to use them online or in-store, virtual prepaid cards offer flexibility and convenience for both the buyer and the recipient. So next time you’re struggling to find the perfect gift, consider giving a virtual prepaid card and make gift giving easy.

Ideal for gifting money

Buy Prepaid Credit Cards are becoming an increasingly popular option for gifting money to friends and family. These versatile cards offer a convenient and secure way to give a monetary gift for any occasion, whether it’s a birthday, holiday, or just a simple gesture of appreciation. One of the top reasons why virtual prepaid cards are ideal for gifting money is the flexibility they offer. Traditional gift cards are often limited to specific retailers or restaurants, which can be a hassle for both the giver and the recipient. With a virtual prepaid card, the recipient has the freedom to use the funds wherever they choose, whether it’s online or in-store. This versatility ensures that your gift will be appreciated and put to good use. Another benefit of virtual prepaid cards when it comes to gifting money is the ease and convenience of purchasing and sending them. Gone are the days of going to a physical store to Buy Prepaid Credit Cards; with virtual prepaid cards, you can simply purchase and send the card online with just a few clicks. This makes it the perfect option for those last-minute gifts or if you’re unable to meet in person to exchange gifts. Virtual prepaid cards also offer a level of security that traditional gift cards may not provide. Since these cards are typically not tied to a specific account or bank, they offer a layer of protection against fraud and identity theft. In addition, many virtual card providers offer the option to lock or freeze the card if it’s lost or stolen, providing peace of mind for both the giver and the recipient.

Convenient for friends and family abroad

In today’s interconnected world, it’s common for friends and family to live in different countries or even on different continents. This can make it challenging to stay connected and support each other from afar. One way to make life easier for everyone involved is by using virtual prepaid cards. Buy Prepaid Credit Cards are a convenient and safe way to send money to loved ones who may be living abroad. One of the biggest advantages of using virtual prepaid cards is that they can be easily purchased online and sent directly to the recipient’s email address. This eliminates the need for physical cards to be mailed, which can take time and incur additional costs. By sending a virtual prepaid card to a friend or family member abroad, you can provide them with instant access to funds that they can use for a variety of purposes. Whether they need to pay bills, make purchases online, or simply have some extra spending money, a virtual prepaid card offers a quick and secure solution. Another benefit of using Buy Prepaid Credit Cards for international transactions is that they can be used in multiple currencies. This means that the recipient can easily access the funds in their local currency without having to worry about conversion fees or exchange rates.

This can be especially helpful for individuals who travel frequently or have to manage finances in more than one country. For friends and family members living abroad, receiving a virtual prepaid card can be a thoughtful and practical gift. Instead of sending traditional gifts that may not be as useful or appreciated, a virtual prepaid card gives the recipient the freedom to choose how they want to use the funds. This can be particularly meaningful during special occasions like birthdays, holidays, or other celebratory events. In addition to being convenient for the recipient, virtual prepaid cards are also a secure way to send money internationally. With features like fraud protection, account monitoring, and the ability to set spending limits, virtual prepaid cards offer peace of mind for both the sender and the recipient. This can help to prevent unauthorized transactions and protect sensitive financial information. Overall, virtual prepaid cards are a versatile and practical solution for friends and family members who live abroad. From providing instant access to funds in multiple currencies to offering security and convenience, Buy Prepaid Credit Cards offer a range of benefits that make them a popular choice for international transactions. Whether you’re looking to send a gift, support a loved one in need, or simply stay connected with friends and family around the world, a virtual prepaid card can help make the process easier and more seamless.

Customizable options available

When it comes to virtual prepaid cards, one of the biggest advantages is the ability to customize your card to suit your individual needs and preferences. This level of personalization is not typically available with traditional credit or debit cards, making Buy Prepaid Credit Cards a popular choice for many consumers. One of the key customizable options available with virtual prepaid cards is the ability to choose your own design or theme for the card. This can be especially appealing for those who want to add a bit of personality to their card or showcase their own unique style. Whether you prefer a sleek and professional look, a fun and colorful design, or even a custom image of your own choosing,Buy Prepaid Credit Cards offer the flexibility to make your card truly your own. Another customizable option available with virtual prepaid cards is the ability to set spending limits or restrictions. This can be useful for parents who want to give their children a card for making purchases but want to limit the amount they can spend, or for individuals who want to keep track of their own spending habits.

By setting parameters for daily, weekly, or monthly spending, users can better manage their finances and avoid overspending. Additionally, virtual prepaid cards often offer the ability to track and categorize your spending, giving you insight into where your money is going and helping you make more informed financial decisions. Some cards even offer real-time notifications for each transaction, allowing you to stay on top of your finances and monitor your spending in a more proactive way. For those who value security and privacy, virtual prepaid cards also offer customizable options for protecting your personal information. With features such as two-factor authentication, fraud protection, and instant card lock and unlock capabilities, users can feel more confident in the security of their card and the safety of their funds. Overall, the customizable options available with virtual prepaid cards make them an attractive choice for those looking for a more personalized and tailored banking experience. Whether you want to design your own card, set spending limits, track your expenses, or prioritize security, virtual prepaid cards offer a range of customizable features that can be tailored to your specific needs and preferences.

Cost Effective Solution

Buy Prepaid Credit Cards offer a cost-effective solution for those looking to make online purchases without the need for a traditional credit or debit card. One of the main reasons why virtual prepaid cards are considered a cost-effective option is because they do not require a credit check or a bank account. This means that virtually anyone can obtain a virtual prepaid card, regardless of their financial history or current banking situation.

In addition, virtual prepaid cards typically do not come with annual fees or maintenance fees, making them a more affordable option compared to traditional credit cards. This can be particularly beneficial for individuals who are looking to avoid unnecessary fees and charges associated with traditional banking products. Another cost-saving benefit of virtual prepaid cards is that they can help users budget and manage their finances more effectively. Since virtual prepaid cards are pre-loaded with a specific amount of money, users are less likely to overspend or go into debt.

This can be a great way to stay on budget and avoid accumulating unnecessary debt. Buy Prepaid Credit Cards also offer a secure and convenient way to make online purchases. With the rise of online shopping, many people are looking for secure and convenient ways to pay for their purchases without having to disclose sensitive financial information. Virtual prepaid cards offer a safe and secure way to make online transactions without the risk of fraud or identity theft.

Furthermore, Buy Prepaid Credit Cards can be easily reloaded with additional funds, allowing users to continue using the card without the hassle of applying for a new card or going through a credit check. This can be particularly useful for individuals who prefer the flexibility and convenience of being able to add funds to their card as needed. Overall, virtual prepaid cards offer a cost-effective solution for individuals looking for a secure, convenient, and budget-friendly way to make online purchases. With no credit check required, minimal fees, and the ability to easily reload funds, virtual prepaid cards are a smart choice for anyone looking to manage their finances effectively and securely.

No overdraft fees

Buy Prepaid Credit Cards,One of the top reasons to consider buying a virtual prepaid card is the fact that it can help you avoid overdraft fees. If you’ve ever experienced the frustration of being hit with an overdraft fee for spending more than you have in your checking account, you know how quickly those fees can add up. With a virtual prepaid card, you can only spend the amount of money that you have loaded onto the card. This means that you won’t be able to inadvertently spend more money than you have, which can save you from costly overdraft fees. Not only can overdraft fees be a financial burden, but they can also be a hassle to deal with. Nobody wants to deal with the stress of having to pay unexpected fees on top of their regular expenses. By using a virtual prepaid card, you can eliminate the possibility of overdraft fees altogether. Additionally, virtual prepaid cards can be a great tool for managing your budget and controlling your spending. Since you can only spend the amount of money that you have loaded onto the card, you won’t be tempted to overspend or go into debt,Buy Prepaid Credit Cards.

This can be especially helpful for those who struggle with impulse buying or have a hard time sticking to a budget. By using a virtual prepaid card, you can have peace of mind knowing that you won’t be charged overdraft fees for spending more money than you have. This can help alleviate financial stress and make managing your money a little bit easier. Plus, the convenience of being able to make Buy Prepaid Credit Cards online or in-person without the risk of overdrawing your account is a major convenience that many people appreciate. In conclusion, one of the top reasons to buy a virtual prepaid card is the fact that it can help you avoid overdraft fees. By only being able to spend the amount of money that you have loaded onto the card, you can prevent the headache of dealing with costly fees and stay on track with your budget. Whether you’re looking to simplify your finances or just want to avoid the frustration of overdraft fees, Buy Prepaid Credit Cards can be a valuable tool in helping you achieve your financial goals,Buy Prepaid Credit Cards.

No interest charges

When it comes to managing your finances, avoiding unnecessary fees and charges is always a top priority. That’s where virtual prepaid cards come in. One of the top reasons to buy a virtual prepaid card is the fact that there are no interest charges associated with them. Traditional credit cards often come with steep interest rates that can quickly add up if you carry a balance from month to month. This means that if you’re not able to pay off your credit card bill in full each month, you could end up paying much more than the original purchase price due to interest charges. With Buy Prepaid Credit Cards, you don’t have to worry about accruing any interest charges because you are only able to spend the amount that has been loaded onto the card.

This means that you can make purchases with peace of mind, knowing that you won’t be hit with unexpected interest fees down the line. Additionally, since virtual prepaid cards are not tied to a credit line, you won’t have to undergo a credit check or worry about your credit score being impacted by your card usage. This can be especially beneficial for those who may have a less-than-perfect credit history or for young adults who are just starting to build their credit. Not having to worry about interest charges can also help you better budget and manage your spending. Without the temptation of carrying a balance and the looming threat of interest charges, you can focus on making responsible purchasing decisions and staying within your financial means,Buy Prepaid Credit Cards.

Low or no activation fees

Buy Prepaid Credit Cards, When it comes to purchasing a prepaid card, one of the top reasons to consider a virtual prepaid card is the low or nonexistent activation fees. Traditional prepaid cards often come with activation fees that can range from a few dollars to upwards of $15 or more. This initial cost can be a significant barrier for some individuals who are looking to use a prepaid card for convenience and security. With a virtual prepaid card, however, the activation fees are typically much lower, or in some cases, completely waived. This means that you can load funds onto your card without having to worry about paying an excessive fee just to get started. This can be particularly advantageous for those who are on a budget or are looking to save money on unnecessary expenses.

Another benefit of virtual prepaid cards is that they often do not come with any hidden fees or charges. Unlike traditional prepaid cards, which may have monthly maintenance fees, transaction fees, or ATM withdrawal fees, virtual prepaid cards usually have transparent fee structures that allow you to know exactly what you’re paying for. This can help you avoid any unexpected charges that can quickly add up and eat into your available funds. In addition to the low or nonexistent activation fees, Buy Prepaid Credit Cards also offer a high level of convenience. Since these cards are digital and can be accessed online, you can easily load funds onto your card from the comfort of your own home. This means that you won’t have to waste time going to a physical store or bank to Buy prepaid Credit cards, saving you both time and effort.

Verified Buy Prepaid Credit Cards?

Buy Prepaid Credit Cards, A verified prepaid virtual Visa card is a type of prepaid card that is issued by financial institutions and operates on the Visa payment network. “Verified” typically means that the card has undergone some form of identity verification process, which may be required for certain online transactions or to meet regulatory requirements.

A virtual prepaid Visa card is one that exists only in digital form, with no physical card being issued. These cards are typically used for online purchases and transactions, providing a convenient and secure way to make payments without the need for a physical card.

These cards can be useful for individuals who want to make online purchases but do not have a traditional credit or debit card, or for those who want to control their spending by preloading a specific amount onto the card.

To obtain a verified prepaid virtual Visa card, you would typically need to apply for one through a financial institution or an online payment service provider that offers such cards. The verification process may involve providing personal information and documentation to confirm your identity. Once verified, you would receive the virtual card details, such as the card number, expiration date, and security code, which can then be used for online purchases wherever Visa is accepted.

Pros and cons of Buy Prepaid Credit Cards?

When it comes to Visa cards, whether it’s a debit or credit card, there are several pros and cons to consider:

Pros:

- Widespread Acceptance: Visa cards are widely accepted both domestically and internationally. You can use them for purchases in millions of locations worldwide, making them convenient for travelers and online shoppers.

- Security Features: Visa offers advanced security features, including fraud monitoring and zero-liability protection for unauthorized transactions. Additionally, many Visa cards come with EMV chip technology, which provides an added layer of security against counterfeit fraud.

- Rewards Programs: Many Visa credit cards offer rewards programs, allowing cardholders to earn points, miles, or cash back on their purchases. These rewards can be redeemed for travel, merchandise, statement credits, or other perks.

- Convenience: Visa cards offer convenience and flexibility in managing your finances. You can track your spending online, set up automatic payments, and access cash through ATMs.

- Insurance and Protections: Some Visa cards come with additional benefits such as travel insurance, purchase protection, extended warranty coverage, and rental car insurance, providing added value and peace of mind to cardholders.

Cons:

- Interest Rates and Fees: Visa credit cards may come with high-interest rates, annual fees, foreign transaction fees, and other charges. Failure to pay off the balance in full each month can result in accumulating interest charges, increasing the overall cost of purchases.

- Debt Risk: Credit cards, including Visa cards, can lead to debt if not used responsibly. Carrying a balance from month to month can result in accruing interest and potentially digging yourself into debt.

- Overspending: The convenience of using a Visa card for purchases may lead to overspending if not used judiciously. It’s essential to budget and manage your finances responsibly to avoid accumulating debt.

- Security Risks: While Visa cards offer security features, they are not immune to fraud and identity theft. Cardholders should remain vigilant in safeguarding their card information and report any suspicious activity promptly.

- Dependency on Technology: Visa cards rely on electronic systems and networks, which can be susceptible to outages, technical glitches, or hacking attacks. This dependency on technology can pose challenges if you encounter issues with card usage or transactions.

How Does Virtual Prepaid Visa Card Work?

A virtual prepaid visa cards is only available online. This card is similar to traditional ones, with the Only an online virtual prepaid visa card is available. The only difference between this card and regular ones is that it does not have a physical shape. It has all of the features of a traditional prepaid visa card. It includes a unique 16-digit number, an expiration date, and a Card Verification Value (CVV) number.

This virtual prepaid Card, like a regular Visa card, may be used to make online purchases. The automated prepaid visa card, on the other hand, is linked to a secure online account rather than a credit card or a bank account. You may Buy prepaid Visa Cards from us online since we have the Prepaid Credit Cards available. So, if you want to buy a Visa prepaid card online, I don’t think you’ll find a better option than us.

jakubpalesch –

Bought a $300 Visa Prepaid Cardand it works fine.

Kevin –

premiumvcc was quick and very easy to use. And the options for both purchases and payments was extensive.

Cursed Requiem –

Has never failed me. premiumvcc has been great so far. When getting Visa Prepaid Card with a USDT balance this is the best way so far!

Tomas bar. –

This app is so easy to use. Loads of different Visa Prepaid Cards to choose from. Can pay in several ways including BTC.

Barsness –

I have tried other sites you all make it easy to purchase online I’ve been using other sites where it takes up to hours to complete a transaction

Got my Visa Prepaid Card direct after payment. Only thing is that on the site it said 1000$ and after redemption it said 1010$

premiumvcc –

Thank you for your review.

Sorry for our late reply

Markus –

Fast delivery. Understandable description of how to the $1500 Visa Prepaid Card, everything worked without any problems. Only recommended

paybismoney –

Thank you for your review.

Sorry for our late reply

Monnie Pearl –

This site is Great, they Delivery me 65000 usd and I was Happy, get back all Great web site best web site premiumvcc.com ♥♥♥♥♥♥

Jair –

For the past 2days, I have been getting wonderful service. And I am able to maintain good connection with people who I have bought $400 Visa Prepaid Card for. Now in the past, premiumvcc.com used to cut my transactions short mainly because I didn’t have an account with them.

Premiumvcc makes your tranactions fast and easy, i have never had any trouble with the purchase or use of Visa Prepaid Card.

Hunter –

The process to purchase the $500 is simple and you get the code/card instantly. The service charge is reasonably priced. Nothing for me to complain about.

Premiumvcc –

Thank You Sir

Jamie –

I personally thank you & will be spreading the word further that if someone needs a online $500 Virtual Prepaid Card… premiumvcc is the word to search into their search engine.

Thanks again!! Keep the good work going.

timon schork –

Purchasing an $2000 Visa card was fast and easy with Premiumvcc! I chose my cards, chose the denominations, completed my charge card information and very shortly after thatI received my card numbers.

Premiumvcc –

Thank you very much for the nice comment sir

Macho –

Late delivery $200 Prepaid Credit Cards but support is great

Premiumvcc –

Sorry Sir

Lucia –

got what I needed very efficient service, I didn’t have to write down my life history, not like the previous service I was dealing with was ridiculous.

There were so many steps I could have built a Stairway To Heaven.

Thank you so much. One satisfied customer.

Premiumvcc –

thank you sir

k.m.mcpherson –

The 1-star reviews are lying clearly, it worked well I spent $400 prepaid credit cards on prepaid credit cards and them perfectly fine.

Premiumvcc –

Thank you very much for the nice comment sir

asiakas –

Trustworthy $200 prepaid credit cards site. I have used many times. Fast and efficient!👍🏼recommended

Premiumvcc –

Thank you very much for the nice comment sir

Sherri –

The site was easy to maneuver through it. A lot easier than trying to find what I need in the store it’s all right their. Id use this again and I’d refer people to premiumvcc. Very fast efficient and just an all out great purchase and speed of what I needed.

Premiumvcc –

thank you sir

Drin Morina –

Easy payment and got the $200 prepaid credit cards immediately in the website also in form of a email. 10/10, Communication Telegram

Premiumvcc –

thank you sir